Honey Sessions: The Budgetnista Shares How to Budget Without Budgeting

We could obsessively watch the market and follow titans of industry for advice on how to make the most of our money. Or, we can learn practical tips — and have fun doing it — from a financial guru who knows what it’s like to be broke. Enter today's Sessions Lead: Tiffany Aliche a.k.a. The Budgetnista.

The financial expert not only maneuvered her way out of $300,000 in debt after losing her job as a preschool teacher, she has turned her experience into a thriving career. Now, in her pursuit to bring realistic and game-changing financial help to people around the world, Aliche has penned a best-selling book and cultivated a community of millions (known as the #livericher group), which saved more than $200 million along the way. With stats like that, who couldn’t learn a thing or two from The Budgetnista? We asked the money maven to return to her teaching roots and school us in smart personal finance. Ahead, find her best tips for budgeting...without a budget (read: if you can’t stand math, this is for you).

Get prepped with a few of her must-have tools for making savings not just a success, but a whole mood.

Aliche’s best-selling book breaks down exactly how to make a budget and “get grown with it,” as she likes to say, with step-by-step guidance on how to manage money.

SHOP: The One Week Budget: Learn to Create Your Money Management System in 7 Days or Less!, $15.97, available at Barnes & Noble

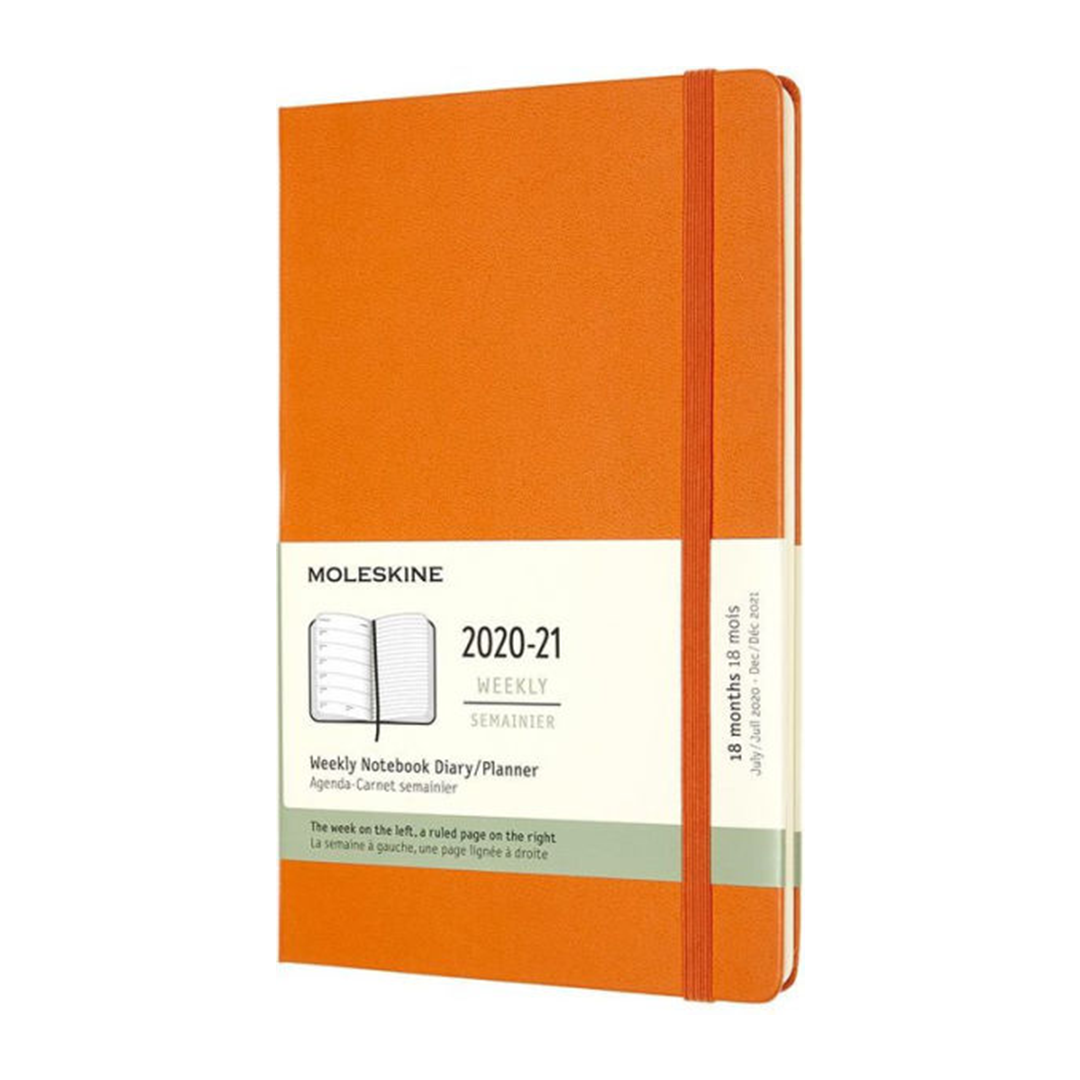

“There’s something about a notebook that feels executive,” Aliche says. This leather-bound, hardcover version features an 18-month weekly planner that runs from July to December, which means there’s never been a better time to snap one up and start budgeting.

SHOP: Moleskine 2020-21 Weekly Planner, $22.95, available at Barnes & Noble

If the idea alone of budgeting puts you on edge, spark serenity now with this candle that recreates the tranquility of Capri (thanks to lemon, bergamot, and an array of other citrus notes). As The Budgetnista notes, scents can evoke energy, joy, or relaxation, so why not set the mood with a candle?

SHOP: Capri Blue Iridescent Jar Candle, $32, available at Anthropologie

The Budgetnista has a whole plan for taking the headache out of budgeting (and lighting a candle is just the start).

Instead of having your entire check deposited into your checking account with each pay period, request it be split among four different accounts: two checking accounts and two savings accounts. (Making this request will require an email to HR or accounting, but it’s something the bookkeeping folks can handle easily.)

Use the first checking account as a hub for bill-paying, with most of your money landing in this account to cover your monthly bills. From there, set up automatic bill pay and you won’t have to stress about missed deadlines (and late fees) ever again.

Tap the first savings account as an emergency fund. Work to load this account with enough money to cover six months of essential expenses (like rent or mortgage). That way, when the unexpected strikes (hello, Covid-19), you have a healthy cushion to help keep you afloat.

Now for the fun stuff: The second checking account is dedicated to everyday spending. As Aliche notes, this should be the only account to which a debit card is attached. Use this account for entertainment, nights out, and to buy those shoes you’ve had your eye on.

Lastly, earmark the second savings account as long-term savings. This is where you’ll funnel money to be used on bigger purchases (like buying a car or home). As Aliche notes, long-term retirement savings should be taken out of your paychecks before they even land in your account, so make sure you’re taking care of your older self by talking to HR about retirement contributions now. For more details on mastering Aliche’s plan (and major keys on getting pizza rich), press play on the video, above.

Looking for extra credit? The Budgetnista has a few more budgeting hacks to push your money even further.

Tap Budgeting Tools

Those with an aversion to budgeting can find solace in knowing you don’t have to review your funds every single time you shop. Instead, Aliche uses tools like Honey to help maximize savings with some purchases and track price histories to make sure she’s getting the best deals. This applies to everything from utility items, like batteries, to more extravagant purchases, like sneakers or jewelry.

Make Saving Pennies Count

The act of saving is just as important as the figures you stack. “When I was at my most broke and sleeping on a couch, I used to transfer a dollar a month from a checking account to a savings account,” Aliche says. “I did that intentionally; not because a dollar was going to transform my life, but because it helped me maintain the habit of saving.” Show yourself you can save by making regular deposits (whether it be to a piggy bank or a savings account). Then, take a look at how you can increase those deposits.

Do you not make enough money to save? If most of your money goes to monthly bills, you may need to look for another job, negotiate a raise, or launch a side hustle. If you do make enough to save, look at where you can slash expenditures that aren’t working in your best interest. Once you’ve pinpointed how you can boost your savings account, take the next step and delegate that money for savings by setting up auto deposits.

Automate Your Budget

If budgeting feels too restrictive (or you’re just aren’t a math person), there’s a way to maximize your savings without obsessing over numbers. “The great thing about a budget is if you set it up, you can semi-forget it,” Aliche says. Her advice: Use 30 minutes to write down your monthly expenses. Subtract that figure from your take-home pay to find a base number you can funnel into savings. If your base number feels anemic, go line-by-line through your monthly expenditures to see where spending can be reduced. Once that’s done, set up automated payments to cover bills and direct deposits to feed savings accounts. “Set it and semi-forget it,” Aliche says. “Suck it up for 30 minutes so you can live 30 years with a strong, working automated budget.”