401k vs IRA: Retirement Planning Made Easy

Fast forward to retirement. You might entertain futuristic visions — uprooting to a Mars colony or undergoing singularity. Or imagine enjoying everyday moments, like refining your pottery techniques, writing that romance novel, or being near those you call loved ones.

To enter your Second Jubilee, you’ll first need to save. While the amount you need to squirrel away depends on your personal situation, you’re probably looking at 12 times your current annual salary if you want to retire by 65, or about $1.5 million.

If you’re just getting started, acronyms for retirement plans like IRAs, 401(k)s, and 403(b)s are easy to gloss over. What is this? Alphabet soup? Here’s what you really need to know about retirement plans — and how you can start tucking away money.

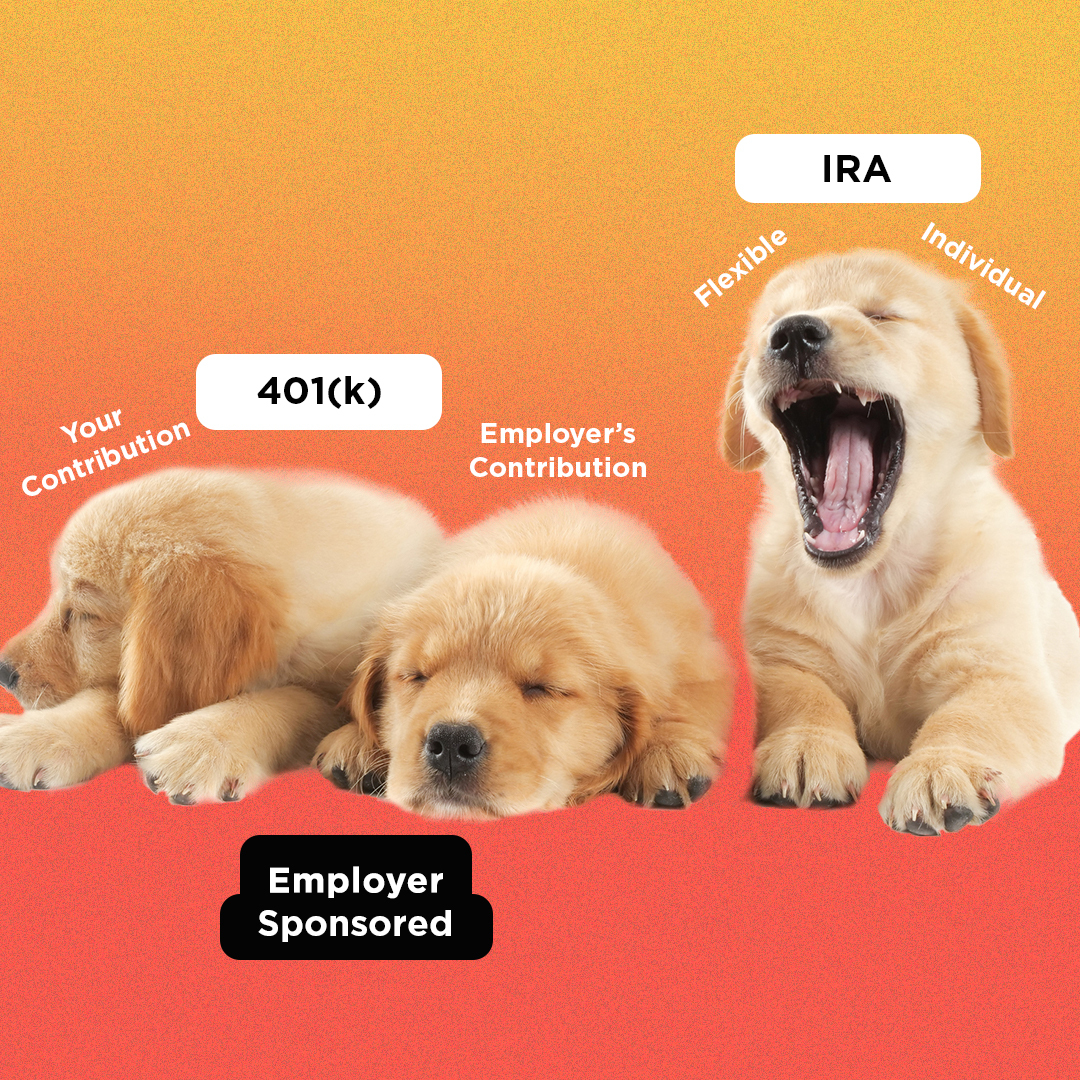

A 401(k) plan is a type of retirement account that your employer might offer. It’s part of your benefits package.

What you need to know: When you start a new job, you’ll want to be clued in to the specifics of your employer’s plan. Will the company match your contribution? If there is one, how much will your employer match? For instance, they’ll match 50% of the money you put in, up to 6%. So for every dollar you contribute, they’ll add 50 cents up to six percent of your income.

You’ll also want to know how long it’ll take for you to be fully vested in the plan. When you’re fully vested, you can take the full employer match when you leave the company. Let’s say it takes five years to be fully vested. If you bid adieu to your current employer in four, you won’t get all of the employer’s contributions to your 401(k).

Tax perks: A major perk of a 401(k) that money you set aside for retirement is from pre-taxed income. Translation: It’s money taken from your paycheck before Uncle Sam takes a cut à la tax deductions. This is a good thing, as you can contribute more of your income. In 2019, you can contribute up to $19,000 a year. If you’re age 50 and up, you can put in an additional $6,000.

To get started: If you can afford it, contribute at least enough to get the full match. It is part of your compensation package, after all. Not taking advantage of a match means that’s money you’d be losing out on. Because contributions made into your 401(k) are coming directly from your paycheck, those are dollars you probably won’t miss.

If you’re worried you can’t swing it, try contributing 1% of your income. Set up your account so you automatically bump up the contribution amount each quarter or at year’s end.

403(b) plans are pretty similar to a 401(k) plan. The tax perks and amount you can contribute each year are the same. Plus, your employer might offer a match. However, 403(b) plans are made available only if you work in public schools, hospitals, or a non-profit. A plus of these retirement plans is that in some cases, once you hit 15 years, you might be able to make additional contributions.

Whereas 401(k) plans are employer-sponsored, which also may come with a match, you don’t need to go through your job to open an IRA.

What you need to know: You can set up these retirement plans on your own. There are two types of IRA accounts: Traditional and Roth. The max amount you can contribute each year is the same for both: $6,000 a year. If you’re 50 or over, you can add an additional $1,000. You can start taking money out when you hit 59 and a half.

Tax perks: The major difference between the two is when you’ll enjoy the tax benefits. With a Roth IRA, you'll pay taxes upfront. However, when it comes time to take money out of your Roth, your withdrawals are tax-free.

On the flip side, contributions you make to a Traditional IRA are made with pre-taxed dollars. In other words, you’ll enjoy the tax perks now. You’ll be taxed on the funds when you start making withdrawals.

You might want to talk to a financial planner about this, but generally, if you're in a lower income tax bracket now, you’ll probably want to contribute to a Roth IRA. Lower income means less taxes. If you predict you’ll be in a lower tax bracket when you retire, you probably want to tuck away money into a Traditional IRA.

Of course, the future cannot be predicted. If you’re unsure as to which account you want to open, you could divvy up your contributions between the two types of accounts. For instance, if you can save the $6,000 max, consider putting $3,000 in your Roth and $3,000 in your Traditional account.

To get started: Decide on which type of IRA is best for your current situation. Then, poke around at different online brokerages and robo-advisors. You’ll also want to figure out how much you can reasonably save on the regular. Ideally, you should set up auto-contributions. The less you have to think about it, the better your odds of building your nest egg.

It’s not intimidating as it seems. Once you get the basic low-down on how retirement plans work, you can make ace choices for future you.