Installment vs. Revolving Credit, Explained in Gumballs and Jelly Beans

When it comes to shopping around for credit, the language can be befuddling, to say the least. Two common terms you've probably encountered but may have thought, WTF: installment and revolving credit.

What do these head-scratcher terms mean, and how are they different from one another?

To help you better understand, we’ll start with a metaphor: Let’s say you’re in the candy business and proudly display two large glass jars in your storefront. The first jar is filled with jelly beans; the second features gumballs.

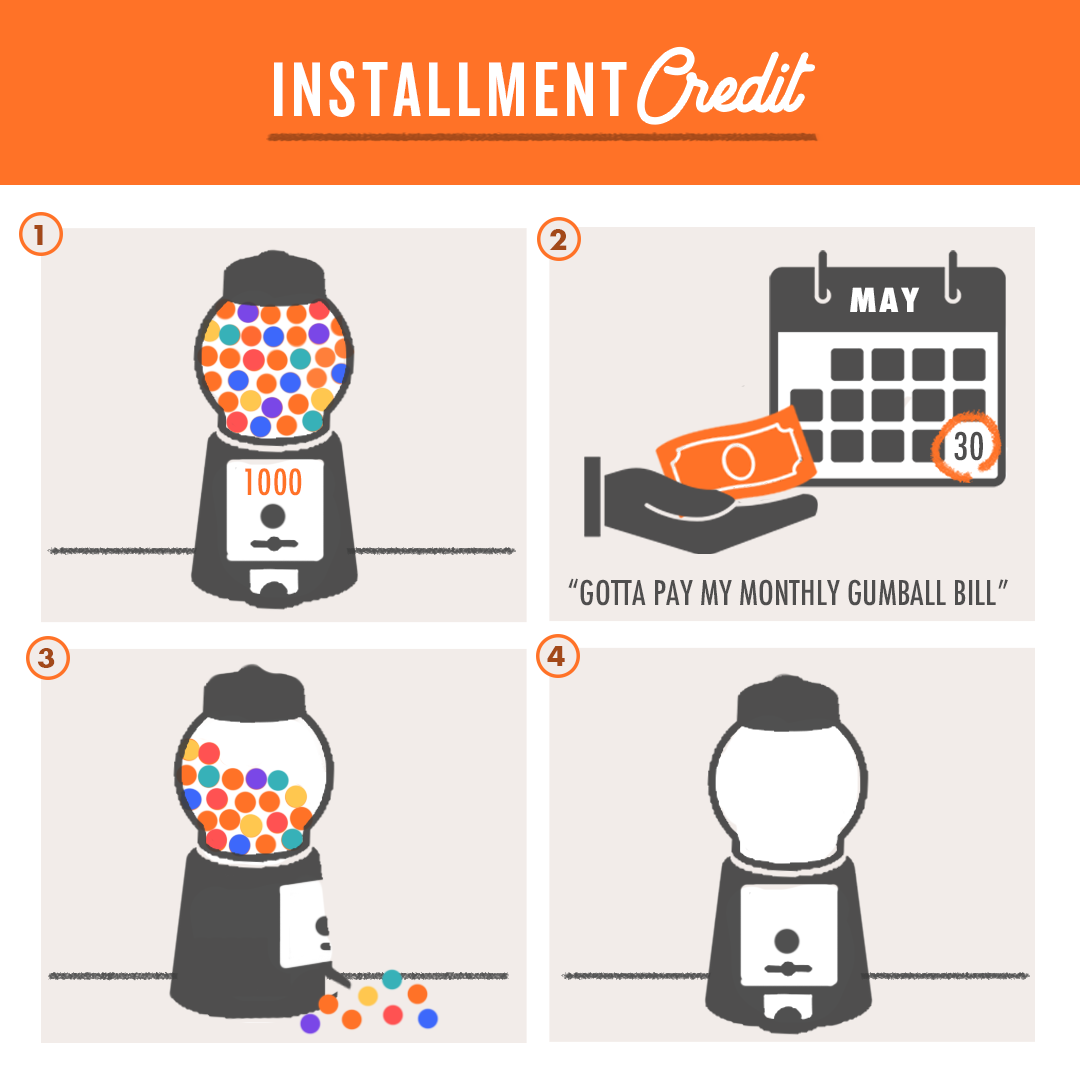

When you made a deal with your candy supplier, Mr. Candy (for lack of a better name), he points out that the jar with the gumballs only comes in bulk quantity of 1,000. It costs 2 cents per gumball. Mr. Candy has agreed to provide the gumballs before you pay him. All you need to do is agree to all 1,000 gumballs upfront. You just need to pay him back a set amount each month. Once you hit zero in gumballs, that’s it — no more gumballs. With the jar with jelly beans, on the other hand, you can have up to 1,000 jelly beans in the jar at any given point in time. Like the gumballs, the jelly beans cost 2 cents a pop.

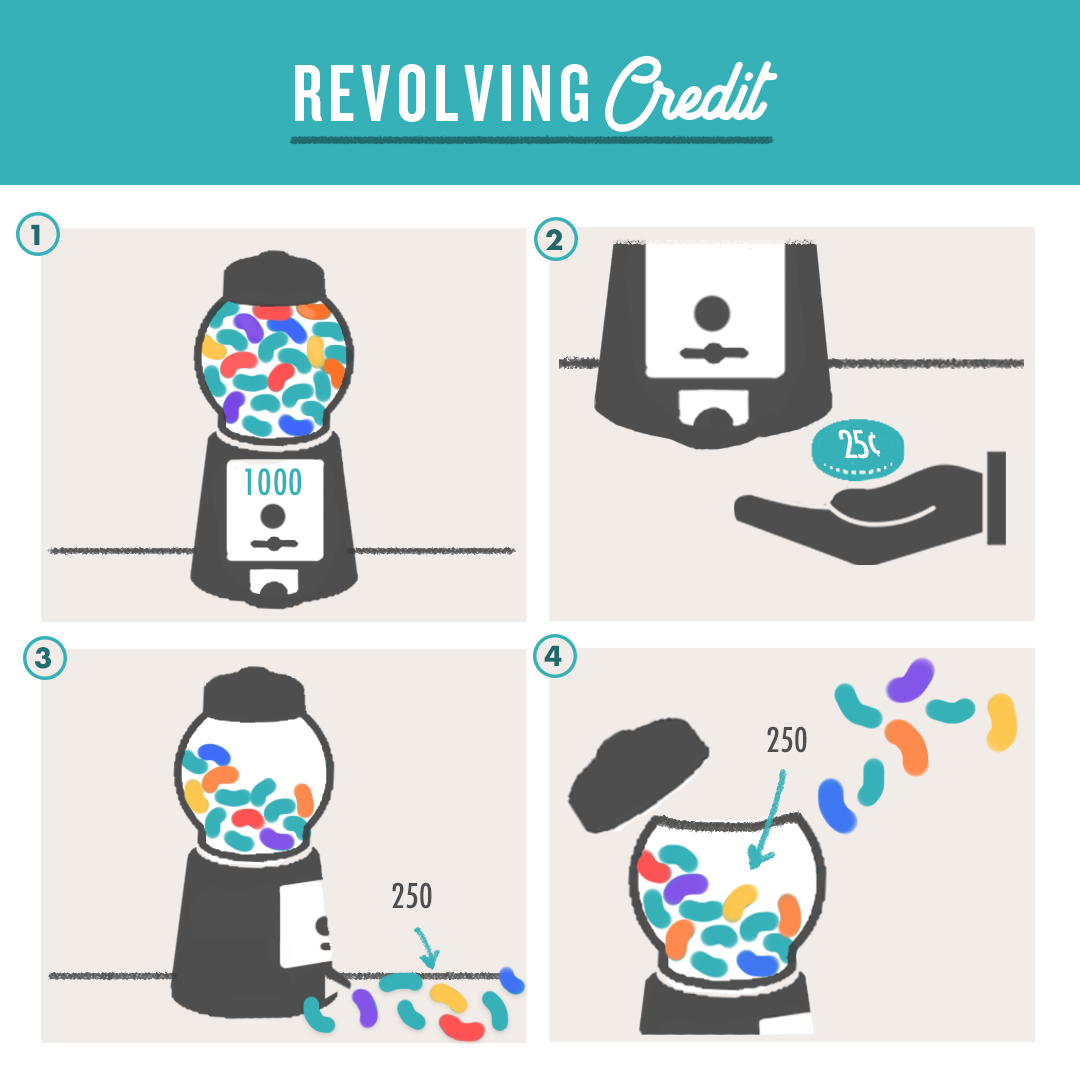

So how do jelly beans compare to gumballs? You can replenish your supply of jelly beans as long as you like.

The kicker is that only pay for the jelly beans you’ve used. Not only that, but the number of jelly beans you can buy from Mr. Candy depends on how many you owe. If you use your 1,000-bean limit, you can’t ask for more of those beans until you’ve paid back the beans you’ve already used. If you pay back 250 of those jelly beans, you can now ask for up to 250 more. The arrangement with the gumballs is how installment credit works. And the jelly beans is how revolving credit works.

Examples of installment credit are mortgages, auto loans, student loans, and personal loans. Installment credit is finite. In other words, you are borrowing a set amount. You obtain X amount on a loan, and agree to pay the same amount each month until the loan is fully repaid. So if you take out a 60-month car loan and owe $200 each month, after five years, or 60 months, you’re done paying off the loan.

When you take out an installment loan, such as on a car or a house, there’s something called the principal, which is the actual amount you’re receiving; and the interest, which is how much you’re being charged for the loan. The interest rate is expressed as a percentage of the loan. So if your interest rate on a car loan is 4%, that’s 4% of the amount you’re borrowing.

Common types of revolving credit are credit cards and lines of credit. With revolving credit, you’re given a credit limit. You’re allowed to borrow as much as you like — as long as you don’t exceed your credit limit. You borrow money against your credit line, pay it back, then continue borrowing money for as long as you please. While the monthly payment amount is the same with an installment loan, it can change each month with revolving credit.

Revolving accounts can be used over and over with really no end date, while installment accounts are finite, explains consumer credit card expert John Ulzheimer, formerly of FICO and Equifax. Unlike installment credit, there’s no specified amount you’re required to pay each month, nor is there a predetermined end date.

As you might imagine, there are interest fees you’ll have to pay on credit lines. The interest rates on installment loans are almost always considerably lower than rates on revolving accounts, explains Ulzheimer.

While both impact your credit, Ulzheimer explains that revolving credit impacts your score far more than installment loans. Missed or late payments will negatively ding your credit. Whether you have a revolving or installment loan, you’ll want to make sure you know what you’re getting into: understand the terms, fees, and interest rates. What’s more, don’t bite off more than you can reasonably afford. So make a point to make your payments on time.

It largely depends. Revolving debt can be used over and over, so if that's important to you then go with a plastic option, recommends Ulzheimer.

“But, if you know of an exact amount you need to borrow then an installment loan is likely to be less expensive, might have tax advantages, and won't have the same negative impact as large amounts of revolving debt,” he says.

What’s more, because some installment loans are only for specific purchases, such as for a house or car, revolving credit might the only financing option between revolving and installment credit.